Is Your Early-Stage Business Ready For Paperless Invoicing? 3 Ways to Make the Change

Will you do us the honor and join our team of authors?

To write for the SohoBlog, contact us at [email protected]

(Shakespearean prose not required.)

As an owner of an early-stage business, you may find that sending invoices takes longer than you would like. You may have heard of ‘paperless’ invoicing, but are unsure of how it works. After all, if you have clients that demand printed invoices, how could you ever become truly paperless? There are several steps to cut down on the amount of paper waste that invoicing generates. This is not only great for the environment, but it can make your task of managing, tracking and organizing your invoicing far easier. Here are the three most common ways that early-stage businesses are moving towards paperless invoicing.

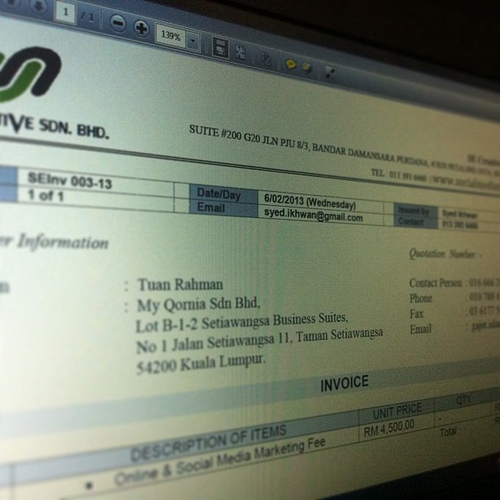

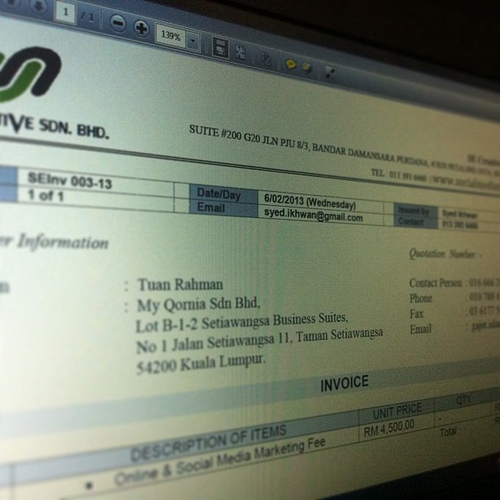

Cloud-based invoice management solutions are rapidly gaining popularity amongst early-stage businesses. The invoicing company, not the business, stores all the data on their own servers. This means that your business would have no need to maintain back-up files on premises. Cloud-based invoicing is built around sending and receiving electronic invoices, or e-invoices. However, employees can also scan and upload any paper invoices or bills. Off-site workers then input and update this information electronically.

For early-stage business-owners sick of keeping track of their finances on a spreadsheet, commercially available software packages, such as Intuit’s QuickBooks Online, are a great way to move towards paperless invoicing. If you are often outside the office, it is highly convenient to be able to access and manage your invoices via your smartphone. You can receive real-time information about your customers’ payment activities.

Invoicing software lets you create invoices and automatically send them, offering a welcome relief to business owners used to printing invoices and putting them into envelopes. You can give your customers a range of ways to pay so the software is about more than just tracking information. According to a recent article by Tom Taulii in Forbes, apps such as Bill.com let you scan bills and send them automatically to QuickBooks, bringing you one step closer to paperless invoicing.

Since some of your customers will always demand or prefer printed invoices, truly paperless invoicing may never become a reality. However, this does not mean that you have to busy yourself with printing and stuffing envelopes. Many early-stage business owners are finding that they can outsource their invoicing to save time and money. Third-party invoicing tools mean that off-site staff can handle the entire billing process for you. Not only can you keep track of every invoice in real time but also external staff will physically print and mail invoices for you, if necessary.

According to our research, moving to paperless accounting isn’t the pinnacle of success that some business owners make it out to be. Early-stage business owners should be more concerned about getting value for money than eradicating paper from their invoicing process. Other important factors that business owners should consider include using custom invoice templates, integrating billing solutions and finding software solutions that offer the flexibility required by the business.